In today’s competitive landscape, business loans can significantly impact a company’s financial health. Understanding the effects of borrowing is crucial for entrepreneurs aiming to enhance their business’s financial stability and foster growth. This article delves into the multifaceted ways business loans can influence your company’s performance, covering both the advantages and potential pitfalls.

Toc

Introduction

Business owners often face financial challenges that threaten their success. This can range from unexpected expenses to cash flow issues, and everything in between. One solution that many entrepreneurs turn to is taking out a business loan.

Business loans can provide the necessary funding for businesses to grow and thrive, but it’s important to understand the potential impact on your company’s financial health. In this article, we’ll explore the various effects of business loans on a company’s finances and provide some tips for managing them effectively.

Pros of Business Loans

- Access to funds: The most obvious advantage of taking out a business loan is having access to much-needed funds. This can be crucial for companies looking to expand, purchase new equipment, or cover unexpected expenses.

- Flexibility: Business loans come in a variety of forms, from traditional term loans to lines of credit and SBA loans. This allows business owners to choose the type of loan that best fits their specific needs.

- Build credit: Taking out and repaying a business loan responsibly can help build your company’s credit score, making it easier to secure future funding if needed.

- Control over repayment terms: Unlike investors or partners who may have a say in how profits are used, taking out a business loan gives you full control over how the funds are spent and when they need to be repaid.

Cons of Business Loans

- Debt burden: Taking on a business loan adds a financial obligation that must be repaid, which can strain a company’s cash flow. This debt can become overwhelming, especially during slow business periods or unforeseen circumstances that impact revenue.

- Interest costs: Business loans come with interest rates that can significantly increase the total amount paid back over time. High-interest rates can eat into profits, making it essential for business owners to shop around for the best lending terms.

- Guarantees and collateral: Many lenders require some form of collateral or personal guarantees, putting personal assets at risk. This requirement can discourage some entrepreneurs from seeking loans due to fear of losing valuable resources.

- Impact on credit rating: Failing to make timely loan payments can negatively affect a business’s credit score, making future borrowing more challenging. It is crucial to manage repayment schedules carefully to maintain financial health.

Managing Business Loans Effectively

To ensure that a business loan positively impacts your company’s financial health, it is essential to manage it effectively. Here are some tips for doing so:

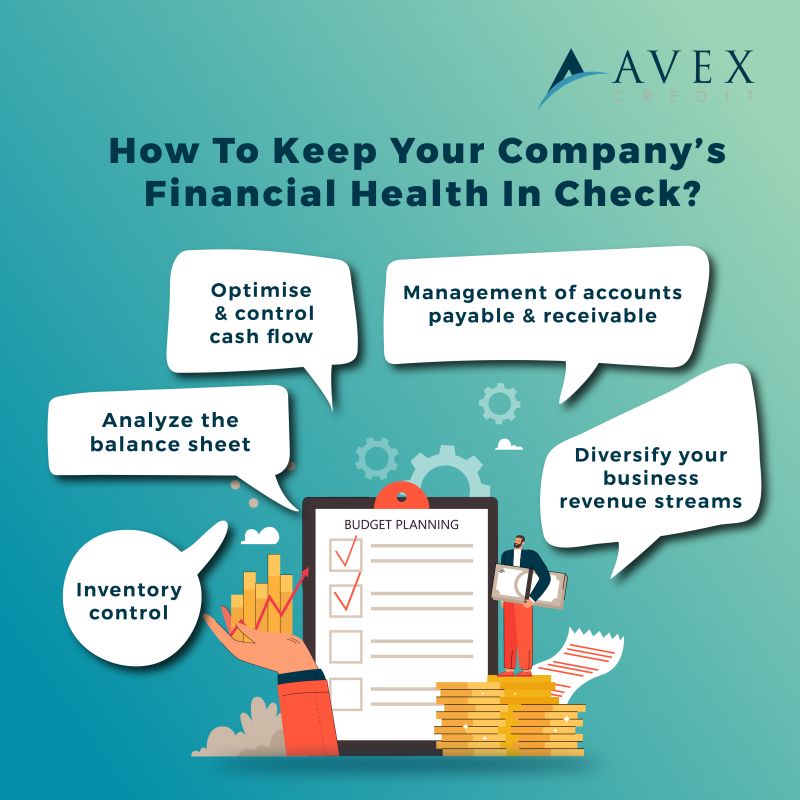

Create a Budget

Establishing a detailed budget is a fundamental step in managing a business loan effectively. Begin by outlining all sources of income and projecting future revenues based on realistic sales forecasts. Next, list all fixed and variable expenses, including loan payments. By having a clear picture of your cash flow, you can allocate funds efficiently and ensure that you meet your repayment obligations without jeopardizing other critical areas of your business. This practice not only helps in planning for loan repayment but also assists in maintaining overall financial discipline.

Monitor Financial Performance

Regularly monitoring your financial performance is crucial when managing business loans. Utilize accounting software or spreadsheets to track income, expenses, and cash flow on a monthly basis. By keeping a close eye on financial metrics, you can identify trends early and address potential issues before they become significant problems. This proactive approach allows you to adjust your operations or spending as necessary, ensuring that loan repayments remain manageable while aiming for business growth.

Communicate with Your Lender

Building a strong relationship with your lender can be beneficial in navigating challenges associated with a business loan. If you encounter financial difficulties or changes in your business landscape that may affect your ability to make timely payments, it is important to communicate with your lender immediately. Many lenders are willing to work with businesses facing hardship and may offer temporary solutions such as payment deferrals or restructuring the loan terms, ultimately helping to safeguard your company’s financial health.

Evaluate Loan Options

Finally, before taking on any new debt, it is advisable to evaluate all available loan options carefully. Compare interest rates, repayment periods, and terms from multiple lenders to find the best deal that aligns with your business’s financial goals. Understanding the full cost of borrowing can help you avoid high-interest loans that may negatively impact your business’s financial health in the long run. By being thorough in your research, you can make informed decisions and choose a loan that not only meets your immediate funding needs but also contributes positively to your company’s future stability.

- https://smartlearnnetwork.com/how-to-use-business-loans-for-maximum-growth-and-profitability/

- https://smartlearnnetwork.com/business-loans-vs-personal-loans-for-entrepreneurs-which-is-right-for-you/

- https://smartlearnnetwork.com/how-to-qualify-for-a-business-loan-tips-for-small-businesses/

- https://smartlearnnetwork.com/understanding-personal-loans-a-comprehensive-guide/

Mitigating Risks

Taking out a business loan can be a risky undertaking, but with proper management and planning, these risks can be mitigated. By carefully considering the pros and cons of business loans and implementing effective management strategies, entrepreneurs can use this financial tool to support their businesses’ growth and success.

Plan Repayments

Creating a well-structured repayment plan is essential for maintaining financial stability while servicing a business loan. Start by assessing your cash flow to determine how much you can comfortably allocate towards loan repayments each month. Establish a timeline that outlines payment due dates and amounts, ensuring you stay on track. Consider setting aside a reserve fund to cover payments during slower revenue periods, thus providing a buffer against potential cash flow fluctuations. Additionally, if possible, it may be wise to make extra payments towards the principal balance when funds allow, as this can reduce the total interest paid over the life of the loan and help you pay off debt more quickly. By proactively managing repayments, you can alleviate the stress associated with loan obligations and maintain a healthy financial position for your business.

Seek Professional Advice

Consider consulting with a financial advisor or accountant when navigating the complexities of business loans. These professionals can provide valuable insights tailored to your specific situation, helping you understand the implications of different loan options and repayment strategies. They can assist in analysing your financial statements to identify potential risks and opportunities, ensuring that you make informed decisions that align with your long-term business goals. Engaging a qualified expert not only aids in effective loan management but also strengthens your overall financial literacy, allowing you to navigate future financial challenges with greater confidence.

Review and Adjust Financial Strategies

As your business evolves, so too should your financial strategies, including how you manage your business loan. Regularly reviewing your loan structure and overall financial health is crucial in adapting to changing circumstances. Set periodic assessments—quarterly or annually—where you analyse your revenue, expenses, and loan repayment progress. This practice will enable you to make necessary adjustments, whether that means refinancing for a better interest rate, altering payment terms, or reallocating resources towards higher-priority areas in your business. Staying dynamic and responsive to your financial landscape can help ensure that your loans contribute positively to your business’s growth trajectory.

Cautionary Note on Loan Management

While business loans can provide essential capital for growth, it is critical to approach them with caution. Over-leveraging can lead to financial distress, particularly if sales projections do not align with actual performance. Entrepreneurs must be mindful of their overall debt-to-income ratio and avoid taking on more debt than they can realistically handle. Additionally, staying informed about market conditions and your business’s operational environment can prevent situations where loan repayment becomes unmanageable. If you find yourself struggling with repayments, seeking assistance early—whether through professional advice or by discussing options with your lender—can mitigate risks and pave the way for recovery. A proactive approach to loan management is key to maintaining financial health and ensuring that debt serves as a tool for growth rather than a burden.

Suggested Further Reading

- “The Ultimate Guide to Business Loans” by The Small Business Administration (SBA) – This comprehensive resource covers various types of business loans, application processes, and best practices for securing financing.

- “Financial Management for Small Businesses” by Investopedia – An informative guide that delves into financial management principles tailored for entrepreneurs, helping you effectively handle loans and other financial challenges.

- “Debt Financing: An Overview” by Harvard Business Review – This article offers insights into the pros and cons of debt financing, including strategic steps for managing borrowed funds wisely.

- “Cash Flow Management for Small Businesses” by the American Institute of CPAs – This resource focuses on cash flow strategies, providing methods to monitor and improve cash flow, crucial for maintaining loan repayments.

- “How to Evaluate Your Business Loan Options” by Forbes – A practical guide that walks you through the various factors to consider when choosing the right loan for your business needs.

Exploring these resources can enhance your understanding of business loans and help you develop effective strategies for managing your company’s financial health.

Conclusion

In summary, while business loans can serve as a powerful catalyst for growth, careful planning and management are essential to navigate the associated risks. By creating structured repayment plans, seeking professional guidance, regularly reviewing financial strategies, and exercising caution with borrowing, entrepreneurs can harness the benefits of debt financing without compromising their financial stability. As businesses evolve in an ever-changing market landscape, maintaining a proactive and informed approach will empower owners to make sound financial decisions that not only support their current needs but also pave the way for sustainable future success. Embracing a comprehensive understanding of these financial tools will ultimately bolster your ability to adapt and thrive in a competitive environment.